Smarter leasing made easy with FleetPartners

SPONSORED

The trade is largely dependent on vehicles, which are essential tools for many small business owners ownership of them outright can tie up valuable cash in assets that go into decline fast.

Management of business vehicles can be a costly, time-consuming drain on your operations, from unpredictable maintenance bills to registration renewals to the hassle of sourcing replacements.

Why is a FleetPartners Fully Maintained Operating Lease* smarter, simpler alternative – turning ownership into one predictable monthly cost supported by expert fleet management support?

1. Keep your cash flow working for your business

Buying or financing vehicles through traditional loans often means large upfront payments and ongoing depreciation.

If you have a FleetPartners Operating Lease, you can save your working capital and keep funds free for the things that really grow your business (such as hiring staff, marketing or new equipment).

No residual or balloon payment is at the end of the term, and no need to worry about resale value. You just back the car and you can upgrade to something new, safer or better suited for your needs.

2. One monthly payment – no surprises

A FleetPartners Fully Maintained Operating Lease bundles everything from registration, insurance, scheduled servicing, tyres and roadside assistance – all major running costs are included in one monthly payment.

This is not meant to be a surprise repair bill or budgeting guesswork, but that means no unexpected fix bills. A simple, predictable cost that helps you manage your cash flow confidently is just a smooth and consistent expense for s.

3. Focus on running your business, not your vehicles

FleetPartners handles the full vehicle lifecycle – from sourcing and delivery to maintenance scheduling and end-of-term replacement.

It provides you with fleet-level purchasing power, national maintenance networks and continued support to keep your team on the road & productive.

For time-poor business owners, it’s an end-to-end solution that saves hours of admin each month.

4. Drive newer, more reliable vehicles

With a FleetPartners Fully Maintained Operating Lease, small businesses can access new, purpose-built vehicles without locking up cash.

Whether it’s utes, vans or electric vehicles (or passenger cars), leasing means your fleet is modern, efficient and professional – the image you want to show for your customers.

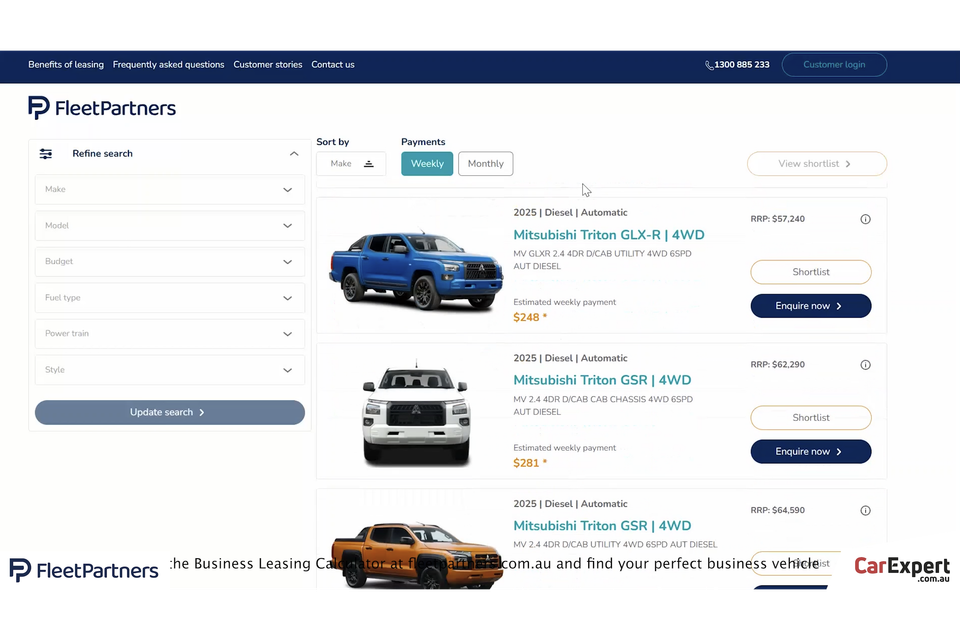

5. Compare and calculate in minutes

The easiest thing is that FleetPartners makes it easier than ever to explore your options,’ said FleetPner. The online Business Leasing Calculator allows ABN holders to compare cars, estimate repayments and start a credit application within ‘a few clicks’.

It’s fast, transparent, and available 24/7, helping business owners make smarter, more strategic decisions about their vehicle costs.

Why choose FleetPartners?

FleetPartners is an ASX-listed company with more than 80,000 vehicles under management across Australia and New Zealand.

That means trusted expertise, national scale, and local support you can rely on.

If you have a partner who understands the challenges of running – and helps you stay one step ahead with an FleetPartners Fully Maintained Operating Lease, your partner is well aware of what it takes to run.

* T&Cs, eligibility and credit criteria apply. Independent advice should be sought

Thanks for reading Smarter leasing made easy with FleetPartners